Citizenship by investment for Iranians: 25 ways to secure global access

A second citizenship is a practical way for Iranians to regain mobility, protect assets and plan for their families without giving up their Iranian passport.

This guide explains how citizenship by investment works, which programs currently accept Iranian applicants, and what it really takes to pass Due Diligence.

What are the main benefits of citizenship by investment for Iranians?

Second citizenship grants

Global mobility

The Iranian passport currently offers very limited travel freedom. Iranians can only travel

Citizenship in another country is a

For entrepreneurs and families alike, this mobility reduces reliance on ad hoc visas, shortens lead times for business trips, and eases access to overseas healthcare and schooling.

Family protection and legacy

Citizenship creates a durable legal status that typically covers the main applicant and close family in one file. Spouses and dependent children can usually be added in a single, coordinated application handled through authorised agents.

Beyond

Banking, business, and property access

A second citizenship, obtained through a government unit, helps standardise documentation for banks, registries and counterparties abroad. Türkiye’s official investment office, for example, sets out the steps for acquiring property and registering title, which many investors pair with citizenship planning.

This simplifies opening bank accounts, buying real estate or opening businesses. When applications are channelled through the program’s authorised routes, timelines are clearer, and counterparties can verify details against official portals.

Regulated, government‑run process

A regulated path matters especially for Iranian applicants navigating

Before you pick a country, you might want to prepare for the checks you will face. All CBI units accept filings only via authorised agents and run enhanced Due Diligence for Iranian nationals, reviewing identity, media accounts, and full source‑of‑funds trails.

Transfers must match the program’s payment route and be fully traceable by SWIFT

[234]

Source: FATF — Wire transfer rules

; unexplained wires are a common reason for delay. We help our clients compile the last

Olga Koltsova

Investment Programs Expert

Olga Koltsova

Investment Programs Expert

Application issues for Iranians and how to overcome them

Iranians obtain second citizenship by starting Due Diligence early, documenting clean fund flows, and following official guidance from program authorities.

Sanctions and Due Diligence

International sanctions mean applicants from Iran face deeper background checks. These reviews verify identity, business activity and the legal origin of funds, and they are performed by both the licensed agent and the government unit.

Enhanced Due Diligence is not a hurdle when documents are clean and consistent. Early compliance reviews shorten timelines and prevent issues with banks and correspondent partners later in the process.

Applicants are expected to pass the following enhanced checks:

cross‑border identity verification and database screening;- independent background reviews of companies and associates;

- full source of funds and source of wealth analysis with documentary proof.

Banking and payments

Moving money internationally can be complex under sanctions and correspondent banking rules. Clear payment routes, matching invoices and transparent account histories reduce friction and prevent delays.

Applicants who plan their transfers in advance typically progress faster. Aligning bank letters, tax returns and sale contracts with the investment payment schedule helps the government unit and the receiving bank to reconcile every step.

When preparing funds and documents, programs usually expect evidence such as:

- bank statements and sale contracts that prove the legal origin of funds;

- tax filings and corporate records that support the declared wealth;

- payment trails that match the investment route and can be audited later.

Compliance frameworks

All recognised programs operate under government rules with defined routes, fees and forms. Competent authorities publish guidance and maintain agent registers, which sets a consistent standard for applicants.

For European options, applicants should follow national instructions and track regional developments. For Caribbean and other routes, the program unit is the single source of truth on eligibility and document formats.

Which countries offer citizenship by investment to Iranians?

Several countries legally accept Iranian applicants through transparent,

Caribbean and Vanuatu programs such as Antigua and Barbuda, Grenada, Dominica, and Vanuatu remain the most established and popular choices among Iranian investors. These island nations combine moderate investment thresholds, quick processing times, and strong international recognition.

Turkey and Egypt appeal to Iranians looking for closer cultural and geographic ties, stronger trade opportunities, and the option to invest in real estate or deposits with tangible returns.

Although the required investments are higher, these routes often provide a faster path to physical relocation and

Jordan, El Salvador, Sierra Leone, and São Tomé and Príncipe are developing new citizenship frameworks. Their terms and timelines are evolving, but they signal a broader global trend of governments using citizenship by investment models to stimulate national economies and diversify foreign capital inflows.

Comparison of citizenship by investment available for Iranians

| Country | Minimum investment | Processing time | Availability for Iranian applicants |

|---|---|---|---|

| Antigua and Barbuda | $230,000 | Available if the applicant has not lived in Iran for | |

| Dominica | $200,000 | Available if the applicant has not lived in Iran for | |

| Vanuatu | $130,000 | Available — enhanced Due Diligence required | |

| Türkiye | $400,000 | Available — standard Due Diligence applies | |

| El Salvador | $1 million in BTC or USDT | Available — via Freedom Visa route | |

| Sierra Leone | $140,000 | Available — | |

| Egypt | $250,000 | Available — funds must come from abroad via traceable banking | |

| São Tomé and Príncipe | $90,000 | Available under new program launched in 2025 | |

| Jordan | $750,000 | Available — subject to security clearance | |

| Nauru | $105,000 | Available through the Economic and Climate Resilience Program |

Caribbean and Vanuatu citizenship by investment programs

For Iranian applicants, the Caribbean and Vanuatu offer

Dominica and Antigua and Barbuda allow Iranians to apply only if all of the following are true: they have not lived in Iran for at least 10 years, they do not hold significant assets there, and they have not been involved in business or similar activities with Iran [235] Source: Antigua CIU — restricted countries .

St Kitts and Nevis, St Lucia and Grenada list Iran among barred nationalities.

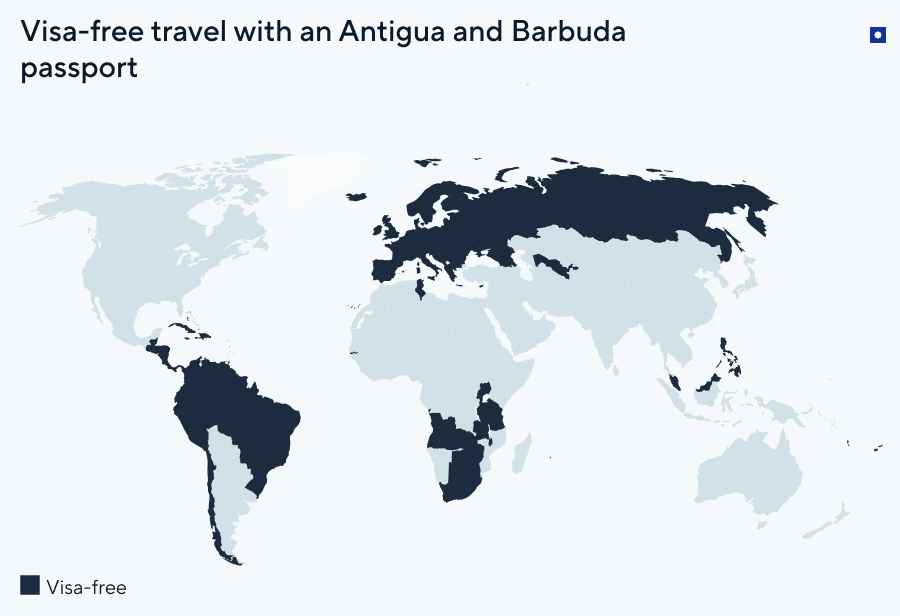

Antigua and Barbuda

Antigua and Barbuda grants citizenship through a government program that allows an investor and family to obtain a second passport by making a qualifying investment and passing Due Diligence [236] Source: Antigua and Barbuda CBI program, CIU .

Citizens must spend a total of five days in the country within the first five years to keep their passport renewable.

Investment options. To qualify, an investor must commit capital under one of the approved routes:

- $230,000 — National Development Fund: a

one‑time ,non‑refundable contribution paid to the NDF; - $260,000 — University of the West Indies Fund: fixed contribution for a family of six or more;

- $300,000 — approved real estate: purchase in a

CIU-approved project, held for at least five years; - $1,500,000 solo or $5,000,000 joint — approved business: either a single investment of $1,500,000 or a joint investment totalling $5,000,000 with at least $400,000 from each investor.

Eligible family members. A lawful spouse is eligible. Children of the main applicant or of the spouse are eligible up to age 30 when they are financially dependent on the principal applicant.

Adult children who have a physical or mental disability are eligible when they live with and are fully supported by the main applicant. Parents and grandparents of the main applicant or of the spouse are eligible from age 55 when they are financially dependent on the principal applicant.

Unmarried siblings of the main applicant or of the spouse may also be included.

The program further allows adding a future spouse of the main applicant, a future spouse of a dependent child who remains financially dependent, and a future child of a dependent child.

Dominica

Dominica’s citizenship by investment program allows an investor and family to become citizens by making a qualifying contribution or purchasing approved real estate and passing Due Diligence.

The program is run by the government’s Citizenship by Investment Unit, which publishes the official rules, fees and forms [237] Source: Dominica CBI program, regulations .

Investment options. To qualify, an investor must commit capital under one of the approved routes:

Non‑refundable state contribution of $200,000 for a single applicant; $250,000 for a family of up to 4 applicants, with extra $25,000 for each additional dependant under 18, and $40,000 per additional dependant aged 18 or over.- Real estate purchase for at least $200,000 in a

CBIU‑approved project. Government fees apply in addition to the purchase price, and the asset must be held for 3 years, or 5 years if resold to another CBI applicant.

Eligible family members. A lawful spouse can be included. Children under 18 qualify; children

Dependent children with a physical or mental disability qualify at any age, and dependent parents or grandparents of the main applicant or spouse qualify from 65.

Vanuatu

Vanuatu’s citizenship by investment lets an investor and family obtain citizenship by making a qualifying state contribution and passing Due Diligence, with typical processing in about two to four months.

The program is administered by the Vanuatu Citizenship Office and Commission, which publishes official guidance and notices. Note that the European Union ended

Investment options. To qualify, an investor must commit capital under the published donation routes, with the minimum shown first:

-

Non‑refundable contribution — $130,000. A state contribution that supports Vanuatu’s economic development and disaster recovery. The amount increases by $20,000 if a spouse is included and by $15,000 for each additional applicant. - Cocoa Fund contribution — $157,000. Funds go to the CNO Future Fund to expand coconut oil production as a renewable energy source. The amount is fixed for families of up to four. From the fifth family member onwards, add $26,500 per person. After five years, $50,000 or more may be refunded under program rules.

- Coconut Fund contribution — $159,500. Investments go to the Sustainable Development Fund to develop cocoa production, one of Vanuatu’s key export commodities. The amount is fixed for families of up to four. From the fifth family member onwards, add $25,000 per person. After five years, the government plans to refund $50,000 or more under program rules.

Eligible family members. A lawful spouse and children are eligible to be included. Children are generally accepted up to 25 when financially dependent, and parents or grandparents can be included from 50, subject to program rules and fees.

Türkiye

Türkiye allows an investor and family to obtain citizenship by making a qualifying investment and passing security and

The most popular route is purchasing real estate for a minimum of $400,000, with a

Investment options. To qualify, an investor chooses from one of the following investment routes:

- $400,000 in real estate. Investors can buy residential or commercial property. After the mandatory

three‑year holding period, the investor may sell the property to anyone, but the new buyer cannot use that asset to apply for Turkish citizenship by investment. - $500,000 in a bank deposit. The applicant places funds in a Turkish bank and maintains the full balance for three years. The bank reports account compliance to the government.

- $500,000 in government bonds. The applicant buys approved bonds and holds them for three years.

- $500,000 in other financial or capital investments. The applicant invests in

fixed‑capital projects or units in authorised investment funds, obtains ministerial certification, and keeps the investment for at least three years.

Eligible family members. The investor’s spouse and unmarried children under 18 can obtain citizenship as dependents on the same application, subject to the standard checks.

Egypt

Egypt allows an investor and family to obtain citizenship by completing one of the

Investment options. To qualify, an investor must commit capital under one of the approved routes, in US dollars transferred from abroad:

- $250,000 —

non‑refundable contribution. A donation to the state treasury credited to the Unit’s special account at the Central Bank of Egypt. - $300,000 — real estate investment. Purchase

government‑owned or designated property; one or more units or land are allowed, including those under construction. The property may be sold after 5 years. - $350,000 + $100,000 donation — business investment. Invest in a new or existing Egyptian business and maintain it for at least 5 years, plus a separate $100,000 contribution to the treasury.

- $500,000 — bank deposit. Transfer to the Unit’s special account; the sum is refundable after 3 years in local currency, without interest.

Eligible family members. The main applicant may include a spouse and unmarried children under 21 as dependents on the same file, subject to Due Diligence and document requirements published by the authority.

El Salvador

El Salvador offers a

Investors submit applications through the state’s Adopting El Salvador online platform. It verifies the crypto transaction, issues confirmation to the applicant, and forwards the file for Due Diligence and final approval by the Ministry of Foreign Affairs.

Investment options. To qualify, an investor makes a $1,000,000 contribution in Bitcoin or USDT. It is paid via the Adopting El Salvador platform and is the basis for

Eligible family members. The main applicant may include a spouse and children under 18 on the same file.

Jordan

Jordan grants citizenship to qualifying investors who meet strict investment and

Investment options. To qualify, an investor must commit capital under one of the approved routes:

- $750,000 outside Amman with at least 10 jobs for Jordanians, or $1,000,000 in Amman with at least 20 jobs.

- $1,000,000 in returnable treasury bonds for six years, with interest set by the Central Bank of Jordan.

- $1,500,000 purchase of shares in Jordanian companies, with the shares held for at least three years.

Eligible family members. An investor may include a spouse, children under 18, unmarried, widowed or divorced children over 18 who are financially dependent, and dependent parents, subject to the government’s security and document checks.

Nauru

Nauru offers a

Investment options. To qualify, an investor must commit capital under the approved contribution route, with funds paid to the state Treasury:

The contribution supports Nauru’s economic development and

Eligible family members. Applications may include a spouse and dependent children, with total costs and

São Tomé and Príncipe

São Tomé and Príncipe have introduced a

Government and press statements in August 2025 confirmed the launch with applications channelled through a new Citizenship Investment Unit. Independent reports add that the framework took effect under a national decree and aims for fast processing.

Investment options. To qualify, an investor must commit capital under the approved donation route and follow the official filing channel: $90,000 — national development contribution.

Eligible family members. Early program materials indicate that a spouse and dependent children may be included, with some providers citing children up to 30 and parents from 55. Treat these as provisional and confirm exact ages, dependency tests and fees on the program’s official portal at the time of filing.

Sierra Leone

Sierra Leone launched its

Both options are available to Iranian investors and their families, with processing times within three months.

Investment options. To qualify, the investor must select one of the approved options:

- $140,000 — a direct

non‑refundable contribution to national development projects. Each additional family member adds $10,000 to the total. - Purchase of

1—2 kilograms of certified gold. The applicant first obtains permanent residence within 40 days, and citizenship may follow under an accelerated process once the government finalises regulations. Gold may be sold after five years, allowing partial recovery of capital.

Eligible family members. Applications may include a spouse, children under 18, and parents of either spouse of any age. Dependants are included automatically without proof of financial dependency.

How to apply for citizenship by investment for Iranians?

Most investment‑citizenship files move from first consultation to passport in two to nine months. Faster programs with streamlined Due Diligence can be completed in two months, while routes that include property purchase, in‑person oaths, or ministry approvals may take longer.

The processing time depends on how quickly the investor provides the documents, how complex their source‑of‑funds trail is, and how busy the government unit is.

Families with early compliance screening usually move faster than those making last‑minute changes to investments or payment routes.

-

2 weeks

Goals and country shortlist

The adviser interviews investors about budget and family needs, then proposes one to two countries with a written rationale and draft costs.

-

1 day

Preliminary check

The expert screens sanctions lists and media, checks documents for gaps, and maps a clean funds trail. Investors receive a short risk memo with fixes before any submission.

-

5 days

Route selection

Investors choose the exact route, such as fund contribution or real estate. The adviser confirms official fees, timelines and holding periods, and issues a payment schedule.

-

30 days

Document gathering and formatting

The expert gives investors a tailored document list. Their team arranges translations, notarisation and legalisation, and standardises names and dates to match civil records.

-

14 days

Source‑of ‑funds dossierThe adviser compiles bank statements, sale contracts and tax records into a single narrative of investor’s wealth and transfers. They align sums and dates with the program schedule.

-

10 days

Forms and declarations

The expert completes all government forms, affidavits and questionnaires, and prepares dependants’ files. Investors review for accuracy and sign.

-

1 day

Government submission through a licensed agent

The adviser lodges the application with the program unit, obtains the official receipt, and tracks your file in the portal. Investors receive a submission pack and a timeline.

-

2—6 monthsDue Diligence and interview preparation

The expert answers clarifications from investigators, prepares investors for any interview, and provides supporting evidence. Investors attend a brief call if requested.

-

1 day

Approval in principle

The authority issues a conditional approval. The adviser checks the conditions and deadlines, then organises the investment or contribution.

-

7 days

Investment or contribution transfer

The expert coordinates bank routing, beneficiary checks, and SWIFT confirmations. Investors approve the transfer; the team reconciles each step with the unit.

-

30 days

Final approval and oath arrangements

After payment is verified, the adviser secures final approval. If a visit or oath is required, they book dates and prepare investors for the appointment.

-

10 days

Naturalisation certificate and passport

The expert checks spellings and biometric data, collects the documents, and arranges secure delivery. Investors receive a care pack with copies, renewal dates and next steps.

Dual citizenship and Iranian law

Iran does not formally recognise dual nationality. In practice, Iranians who obtain a second passport remain Iranian under Iranian law and cannot rely on their new nationality while in Iran.

For investors who already live or conduct business abroad, this restriction has little practical effect. Outside Iran, their second citizenship is fully recognised by other states, giving them

Residency by investment programs for Iranians

Residency by investment, or Golden Visa programs, suits investors who want the right to live in a country without waiting for full citizenship. They are usually faster to start, allow family inclusion, and can be combined with work, study and property ownership. Many also lead to permanent residence or citizenship after a qualifying period.

For Iranian applicants, the same compliance principles apply as with citizenship routes. Early Due Diligence, a clean source of funds trail, and transfers through traceable banking channels make approvals smoother. Always file through licensed advisers and check the latest rules on the official portals before committing capital.

European residence with strong mobility

Greece Golden Visa — property or other qualifying investments, popular for families seeking Schengen access and flexible stay requirements.

Portugal Golden Visa — diversified investment routes such as funds and cultural projects, valued for a stable legal framework and a path to permanent residence and citizenship.

Hungary Golden Visa — residency through investment instruments or funds, designed for efficient processing and family inclusion.

Italy Golden Visa — investment in

Latvia Golden Visa — residency via investment routes that suit

After

Low tax residence and lifestyle bases

Malta residence permit under the GRP — residence with favourable tax planning for

Andorra residence permit — residence in a secure,

Cyprus permanent residence — a

Business and global gateway options

UAE golden visa —

USA EB‑5 visa — a route to US permanent residence through

Comparison of Golden Visas available for Iranian investors

| Country | Minimum investment | Processing time | Eligible family members |

|---|---|---|---|

| Malta | €30,000 | Spouse, children under 25, siblings, parents, grandparents | |

| UAE | AED 2,000,000 | Spouse, children, parents, domestic staff | |

| Greece | €250,000 | Spouse, children under 21, parents | |

| Portugal | €250,000 | Spouse, children under 26, parents | |

| Italy | €250,000 | Spouse, minor children, dependent adult children, parents | |

| Hungary | €250,000 | Spouse, minor children, parents | |

| Cyprus | €300,000 | Spouse and children | |

| Latvia | €50,000 | Spouse, minor children | |

| Andorra | €600,000 | Spouse, children under 25 | |

| US EB-5 | $800,000 | Spouse, children under 21 |

Choose your citizenship strategy

Each investor’s situation is unique — career stage, family size, travel needs, and business goals determine the best route to citizenship. Below are tailored strategies for Iranian applicants with different priorities.

Entrepreneurs and

- Türkiye — real estate or financial instruments with clear title and robust banking;

- Antigua and Barbuda —

family‑friendly costs and straightforward corporate use of documents; - Egypt — multiple routes, including business investment paired with a growing domestic market.

Mobility first for frequent travellers aim for the widest practical

- Antigua and Barbuda — balanced

cost‑to ‑reach profile; - Dominica — strong

day‑to ‑day mobility for business and leisure.

Speed under tight timelines focus on programs known for efficient decision cycles and clean payment routing:

- Vanuatu — donation routes with rapid processing when files are well prepared;

- El Salvador — Freedom Visa with a single contribution in BTC or USDT through the state portal, designed for streamlined processing;

- São Tomé and Príncipe — new donation route with a compact decision timeline and clear government channel for payments.

- São Tomé and Príncipe — low donation threshold starting at $90,000;

- Vanuatu — donation tiers that suit smaller households;

- Nauru — treasury contribution of $105,000 via the NECRCP.

Key facts about citizenship by investment for Iranians

- A second citizenship is realistic for Iranians when files are clean, transfers are traceable, and the application is lodged through authorised agents.

- Acceptance policies differ by country. Antigua and Barbuda and Dominica allow Iranian applicants under strict conditions and enhanced checks, while St Kitts and Nevis, St Lucia and Grenada currently do not.

- Türkiye, Egypt, Vanuatu, Nauru, Jordan, El Salvador and São Tomé and Príncipe remain popular options.

- Most programs allow to add a spouse and children in one file; some allow parents and siblings.

- Costs depend on the route and family size. Donation paths have lower entry points; real estate, deposits and bond routes require higher capital. Budget for Due Diligence, processing and issuance fees in addition to the headline minimum.

- Timelines are largely predictable when preparation is strong. Two to nine months is achievable on the fastest routes; property acquisitions or complex fund trails extend the schedule.

About the authors

Frequently asked questions

Yes, several countries, including Antigua and Barbuda, Dominica and Turkey, legally accept Iranian applicants under enhanced Due Diligence.

Iranian nationals may also be eligible to apply for citizenship in other countries, subject to the specific eligibility criteria, compliance requirements, and programme conditions applicable in each jurisdiction.

Due to international sanctions, a few countries have temporarily limited applications from Iranian nationals. However, options in other jurisdictions remain open and compliant with global regulations.

Citizenship gives a passport and lifetime rights; residence only grants permission to live in a country. Citizenship offers stronger mobility and security.

Under Iranian law, dual nationality is not officially recognised, Iran treats its citizens solely as Iranian within its territory.

However, Iranians who acquire another citizenship can legally hold a second passport and use it abroad. The distinction lies between recognising dual nationality and allowing individuals to obtain a second one: while Iran does not formally acknowledge the status, it does not prevent its citizens from holding another nationality outside the country.

For Iranians living or investing abroad, a second passport remains fully valid and beneficial for travel, business, and asset protection.

Passportivity helps clients structure transfers through verified international channels, ensuring compliance with banking and sanctions regulations.

Standard documents include passports, birth and marriage certificates, proof of funds, and police clearance. Additional papers may be needed to prove the lawful source of income.

Contact us today

Passportivity assists international clients in obtaining residence and citizenship under the respective programs. Contact us to arrange an initial private consultation.